Charter 101: Own or Charter a Private Jet

/On May 25, 1977, an offbeat young filmmaker named George Lucas released a movie into a handful of U.S. theaters that would go on to transform the motion picture industry. “Star Wars” (quickly subtitled “Episode IV: A New Hope”), melded cutting-edge special effects with classic character archetypes and a dash of humor to create a new type of space opera that drew in countless moviegoers again and again.

Photo Credit: zorazhuang, iStock / Getty Images Plus.

“Star Wars” introduced the concept of summer blockbusters. While both the visuals and the music were unforgettable, the movie also stood out due to its characters – and it made a star of actor Harrison Ford. Ford’s Han Solo was an archetypal rogue who happened to be a great pilot. With giant furry sidekick Chewbacca, Solo flew the Millennium Falcon, which could “[make] the Kessel Run in less than 12 parsecs,” conduct dogfights with TIE fighters and swoop in as backup for hero Luke Skywalker. Almost a half-century later, Han Solo still ranks among the top fictional pilots of all time.

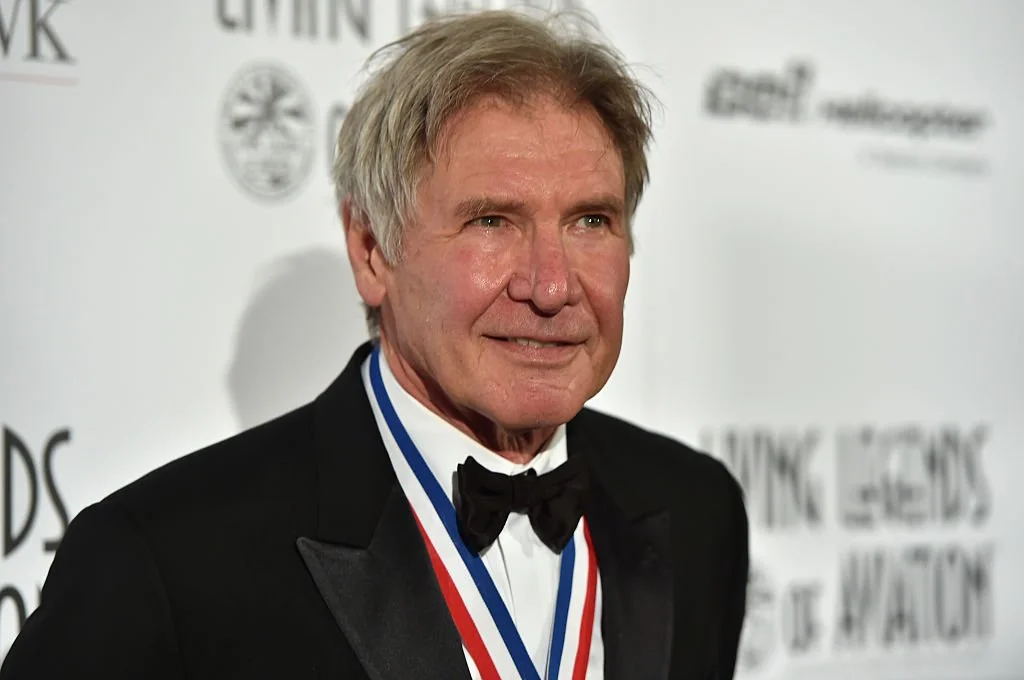

Actor Harrison Ford attends the 12th Annual "Living Legends of Aviation" at The Beverly Hilton Hotel on January 16, 2015 in Beverly Hills, California. Photo Credit: Alberto E. Rodriguez/Getty Images.

For Harrison Ford, reel-life flying was not enough. While his original attempts at flight training in the 1960s had been cut short due to finances, the wealth he gained from “Star Wars,” “Indiana Jones,” Tom Clancy films, and many more allowed him to leverage his fictional experience to soar through actual skies. In the 1990s, Ford purchased a Gulfstream II and restarted flying lessons. Today, he owns an eclectic collection of aircraft ranging from a de Havilland Canada DHC-2 Beaver turboprop to a WWII-era Ryan Aeronautical ST3KR to a Bell 407GX helicopter to a Cessna Citation Sovereign 680 twin-engine private jet. He received the “Living Legends of Aviation – Aviation Legacy Award” in 2006 for his involvement in promoting aviation education and humanitarian work.

There may have been many “Star Wars” movies (plus TV shows, books, action figures et al) over the years, but there is only one Han Solo.* However, Ford and other movie stars aren’t the only ones who have the option to own planes rather than charter them – and, while ownership can make self-piloting more practical, that’s also not required to possess your own aircraft. With demand for new business jets expected to increase about 3% annually on average over the next 10 years, the number of would-be new buyers should continue to rise. If you’re interested in riding along, read on.

In It for the Money

To be clear, purchasing a private jet – as opposed to enrolling in a fractional ownership program such as NetJets – is never going to be the low-cost option. The cost of a business jet will vary based on age, size and features, but the “low end” starts at a few million dollars for a very light jet with limited passenger capacity and goes up from there.

Photo Credit: Valerii Evlakhov, iStock / Getty Images Plus.

Harrison Ford isn’t the only actor who has collected aircraft with the intent to pilot – Morgan Freeman, Brad Pitt and Angelina Jolie all have pilot’s licenses and own planes. Tom Cruise used his passion for aviation to push for real flying in “Top Gun: Maverick” (albeit with trained pilots operating U.S. Naval aircraft out of view of the camera). However, for most of us in the mundane world, the question of whether to own or charter a private jet starts with the number of hours flown per year. While estimates vary, chartering will typically make more sense for those flying fewer than 100 hours per year (with some analysts setting the low bar at 200 hours).

“Owning a jet comes with fixed costs that one does not pay for when chartering an aircraft,” says Janine Iannarelli, founder and president of international aircraft brokerage firm Par Avion Ltd. These fees include taxes, insurance, hangar storage costs and, if you elect to go with a management company, their monthly service fee, along with crew salaries and training. For many private jets, those costs will hit at least seven figures per year regardless of how often (or not) the plane is flown.

As well the direct operating costs, fuel, landing and parking, navigation and catering all require outlay. And then, of course, there’s maintenance, both scheduled and unscheduled. Expenses can add up rapidly.

Fly Casual

However, owning your own private jet carries certain undeniable advantages. Just as charter offers increased privacy, flexibility and security relative to commercial airline travel, owning your own jet offers more of all of those than chartering can provide.

Owners of private jets have the availability to customize aircraft to their liking, selecting the décor, technology and other options that are most valuable to them, rather than making do with the possibilities offered by charter brokers. Those owning private jets will want to make sure that connectivity – be it wi-fi for passengers or satellite communications – keeps up with the latest developments.

Luxury Interior of a private jet. Photo Credit: Aleksandr_Gromov, iStock / Getty Images plus.

Adding new features to an aircraft will help maintain the value of this asset and at times, depending on where one is in the “sales cycle,” boost the marketability of the plane – though some modifications are more value-added than others. “While as a private owner you are free to customize as you would like, I would not recommend completing the aircraft in an unusual color or design unless you are also prepared to redo it prior to sale to make it more appealing to a broader market,” Iannarelli cautions.

Imagine Quite a Bit

One method of offsetting the cost of owning a private jet is to charter that jet out to other flyers when you don’t need it. In addition to the revenue you earn directly, leasing your aircraft out to a Part 135 operator allows you to deduct operating expenses from taxable income, ranging from fuel costs to maintenance and repairs to crew salaries to insurance. There are also options for accelerated depreciation of the asset that can further reduce taxes (more on that in a bit).

In this era of AirBnB and Turo, in which individuals rent out all sorts of assets, it may be tempting to think that leasing an aircraft for charter can be a net wash. This, industry experts say, is a misconception. At most, according to charter operator Clay Lacy Ltd., chartering your aircraft can offset ownership costs by as much as 80% (though that requires both a careful choice of plane type and heavy charter use).

3D Rendering. Photo Credit: OlekStock, iStock / Getty Images Plus.

“Some first-time buyers really believe the airplane is going to pay for itself,” Iannarelli says. “That’s often driven by charter/management companies trying to influence a prospective owner. Bottom line, your aircraft is not going to pay for itself.”

And, of course, the more you make your airplane available for charter, the fewer hours you can fly in it yourself, blunting one of the main advantages of ownership. This may work if your flight schedule is clearly defined months in advance, or if you plan on frequent usage in certain times with no need in others, but otherwise, you’re running the risk that your plane will be unavailable at the times you may most want to have it, whether that’s for a major holiday or the Super Bowl.

Never Tell Me the Odds

A recent development does make the financial picture somewhat more friendly for would-be owners of private jets. In the summer of 2025, the U.S. Congress passed a budget proposal that restored the policy of 100% bonus depreciation – allowing those who buy assets used for business more than 50% of the year to deduct 100% of the cost from taxable income in the first year those assets enter service.

First enacted in 2002 as an economic stimulus tool, bonus depreciation rates have gone up and down over the years – first set at 30%, they were raised to 100% in 2010 after some interim increases, reverted to 50% in 2012, and were upped to 100% again in 2017 (along with being expanded to apply to certain used property rather than just new assets). Rates of bonus depreciation started to phase down by 20% annually in 2023, with a target of 0% in 2027. However, the “Big Beautiful Bill” returned the rate to 100% -- permanently. Though asset owners are not compelled to choose bonus depreciation going forward, some will find it very helpful.

“The bill that passed earlier this year reinstated many of the tax incentives associated with ownership and was a huge boost to aviation as a whole. The Trump administration is very supportive of aviation, and that falls in favor with the aviation community,” Iannarelli mentions. “Bonus depreciation is certainly an added tool in the shed.”

May the Force Be With You

When debating whether to buy a home – usually the first major asset purchase for consumers – potential homeowners are urged to consider factors beyond the dollars involved. Owning a home isn’t just an investment – it’s a lifestyle choice that brings certain financial responsibilities and represents a major commitment. Renting allows for more freedom and flexibility and will be the best option for some people over the long term.

Would-be private jet owners would be wise to keep that approach in mind when deciding whether to keep chartering or to go ahead and purchase. If you’re an occasional flyer, or one who likes variety in your aircraft environment, you’ll likely find charter to be a better fit. However, if you’re a frequent traveler whose priority is to build your asset base, owning a private jet may be the logical next step.

“Private jet investors are usually those who like to own assets because ownership of assets is a pathway to wealth and provides a degree of control over their travel options that may better suit their lifestyle,” Iannarelli concludes. “Before committing to a purchase, ask yourself -- what’s your long-term goal?”

*2018’s “Solo: A Star Wars Story” notwithstanding…